Stablecoins in International Aid and Remittances

Introduction

In recent years, the global financial landscape has been witnessing a significant shift towards digitalization, with stablecoins emerging as a pivotal element in this transformation. Unlike traditional financial systems that often grapple with high fees, slow transaction times, and accessibility issues, stablecoins offer a promising solution to overcome these challenges, especially in the context of international aid and remittances. This post explores how stablecoins are not just redefining cross-border transactions but also bringing about a much-needed revolution in facilitating international aid and remittances.

The Challenge of Traditional International Payments

Traditional systems for international aid and remittances are inefficient, costly, and lack transparency, making it difficult for funds to be sent and received promptly. These systems often involve multiple intermediaries, each adding their layer of fees and delays. A lot of individuals and communities depend on remittances for survival, and are faced with a significant portion of their funds being eroded by transaction fees or delayed by traditional international payment processes.

Understanding International Stablecoin Payments

Stablecoins, designed to maintain a stable value by being pegged to fiat currencies or other assets, offer a novel approach to circumventing these issues. The inherent stability of stablecoins makes them ideal for international transactions, providing benefits such as lower transaction fees, faster processing times, and increased accessibility, even for those without traditional bank accounts.

Stablecoins in International Aid Payments

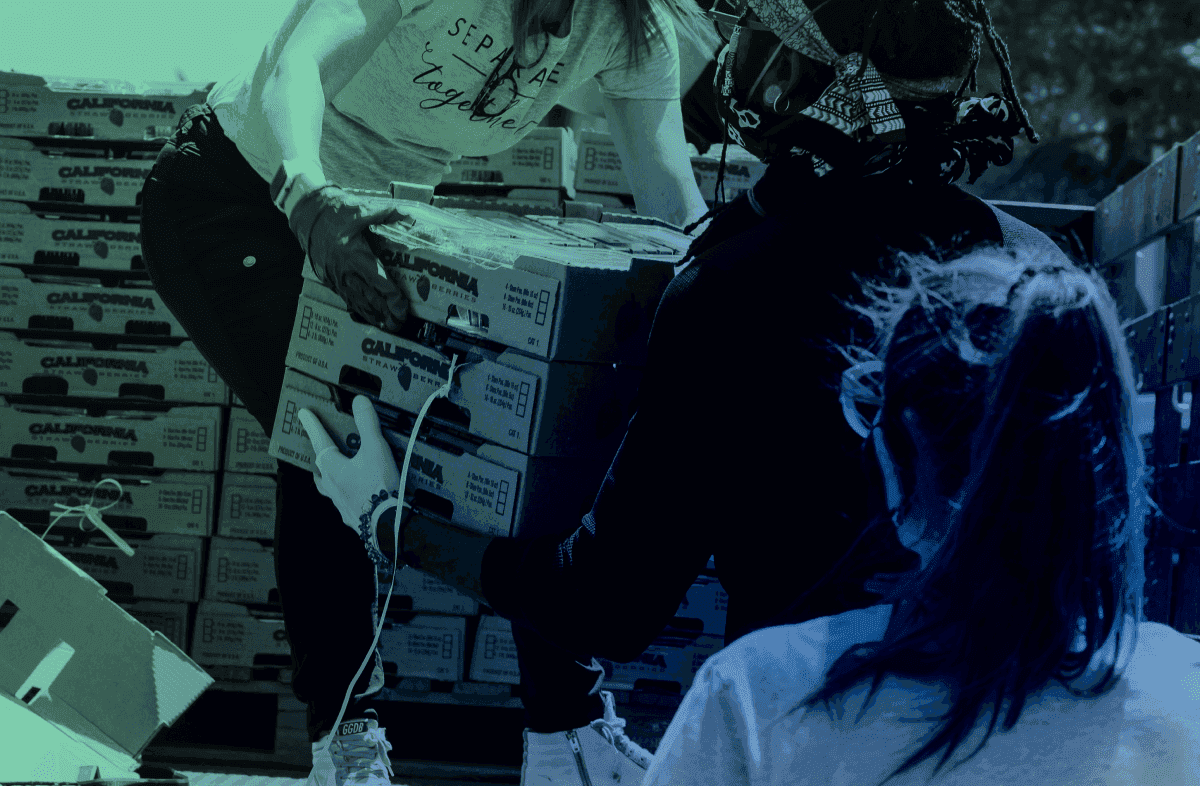

The use of stablecoins can significantly streamline the delivery of international aid. By enabling faster, more direct assistance, stablecoins ensure that help reaches those in need without unnecessary delay or dilution through fees. Organizations and countries have begun to recognize the potential of stablecoins for aid distribution, with case studies highlighting their ability to enhance transparency and accountability in the process. The United Nations, and Circle's collaboration with Airtm are notable examples, showcasing how stablecoins revolutionize foreign aid by ensuring that funds are distributed efficiently and transparently. At the dawn of the Covid-19 pandemic, social workers, doctors and nurses across the world were able to rely on stablecoin payments for cross-border funding in order to deliver aid, especially in countries with a less-developed welfare system; such global payments in stablecoins were instant and saved circa 35% in fees compared to transactions through the traditional banking system.

Even as the world moves forward from the height of Covid-19, the necessity of using stablecoins for cross-border international aid remains strong as ever. Two years since the beginning of the war in Ukraine, The United Nations make a plea for the use of stablecoins in order to reliably and easily send monetary aid to workers and civilians. Carmen Hett, treasurer of the United Nations, stressed how digital dollars can help deliver the funding easily and securely in order “to make sure the money goes exactly where it’s supposed to go…and they need money right now”.

Stablecoins and Remittance Payments

For remittances, stablecoins offer a lifeline to communities reliant on funds sent from abroad, dramatically reducing transaction fees and improving transaction speed. This shift has a profound impact on financial inclusion, enabling individuals without access to traditional banking systems to participate in the global economy. Platforms and services leveraging stablecoin technology have made significant strides in demonstrating how digital currencies can support communities by facilitating easier, more affordable remittances.

Challenges and Opportunities

Despite the promise of stablecoins, their widespread adoption faces hurdles such as regulatory challenges, the need for greater digital literacy, and infrastructure development. However, these challenges also present opportunities for governments, NGOs, and the private sector to collaborate in fostering an environment that supports the growth of stablecoin transactions for aid and remittances.

How Stablecoins Facilitate International Payments

Stablecoins have emerged as a game-changer in the realm of international payments. Their ability to facilitate international payments more efficiently stems from several key characteristics that address the core issues plaguing conventional methods:

Instant Cross-Border Transactions: Stablecoins operate on blockchain technology, which allows for near-instantaneous transactions across borders. Unlike traditional bank transfers that can take days to process due to the involvement of intermediaries and compliance checks, stablecoin transactions can be completed in minutes or even seconds. This speed is transformative for both remittance senders and recipients, as well as for organizations distributing international aid, ensuring that funds reach their intended destination swiftly.

Lower Transaction Costs: One of the most compelling advantages of stablecoins is their ability to significantly reduce transaction costs. Traditional cross-border payments are expensive due to fees charged by banks and money transfer services, currency conversion fees, and the hidden costs associated with delays. Stablecoins streamline the process, minimizing the number of intermediaries and, by extension, the fees associated with transfers. This cost-effectiveness is particularly beneficial for remittance flows into low and middle-income countries, where every dollar saved makes a significant difference.

Enhanced Accessibility and Financial Inclusion: Stablecoins can be sent and received using just a smartphone and an internet connection, bypassing the need for traditional banking infrastructure. This accessibility is crucial for financial inclusion, allowing individuals in underserved or unbanked populations to participate in the global economy. By facilitating direct transfers, stablecoins empower individuals with the ability to manage their finances, receive aid, and support their families abroad without the need for a bank account.

Increased Security and Transparency: Blockchain technology offers enhanced security and transparency compared to traditional financial systems. Each transaction is recorded on a public ledger, reducing the risk of fraud and corruption, particularly in the context of international aid. Donors and aid organizations can track the flow of funds, ensuring that assistance reaches its intended recipients. Furthermore, the inherent security features of blockchain protect against unauthorized access and loss of funds, providing a secure environment for users around the globe.

Stability and Reliability: Stablecoins are designed to maintain a stable value by being pegged to fiat currencies or other assets, making them less volatile than other digital assets. This stability is crucial for users who rely on international payments for their livelihoods or for critical aid. By mitigating the risk of currency fluctuations, stablecoins provide a reliable means of transferring value, ensuring that recipients receive the intended amount without the worry of sudden changes in value.

At Mural, we continue to bring these benefits of stablecoin usage for your businesses’ cross-border payment needs.

The Future of International Stablecoin Payments

The potential for stablecoins to transform the international aid and remittance markets is immense. As the digital finance landscape evolves, stablecoins stand at the forefront of a movement towards more equitable and efficient global financial systems. Their growth signals a future where financial transactions are not only faster and cheaper but also more inclusive and transparent.

Conclusion

Stablecoins hold the transformative potential to make international aid and remittances more accessible, affordable, and transparent. The path forward requires innovation and collaboration among tech companies, financial institutions, and regulatory bodies to leverage stablecoin technology effectively. As Mural continues to champion the use of stablecoins for cross-border transactions, it remains committed to supporting global financial inclusion, underscoring the critical role of digital dollars in shaping the future of global finance.