Exploring the Hidden Fees in International Wire Transfers

In the realm of global finance, international wire transfers are essential for facilitating cross-border transactions. Yet, this convenience often comes with a cost - a complex array of fees that can be challenging to navigate. This post aims to shed light on these charges, including specific fees from different U.S. banks, and suggests ways to minimize them.

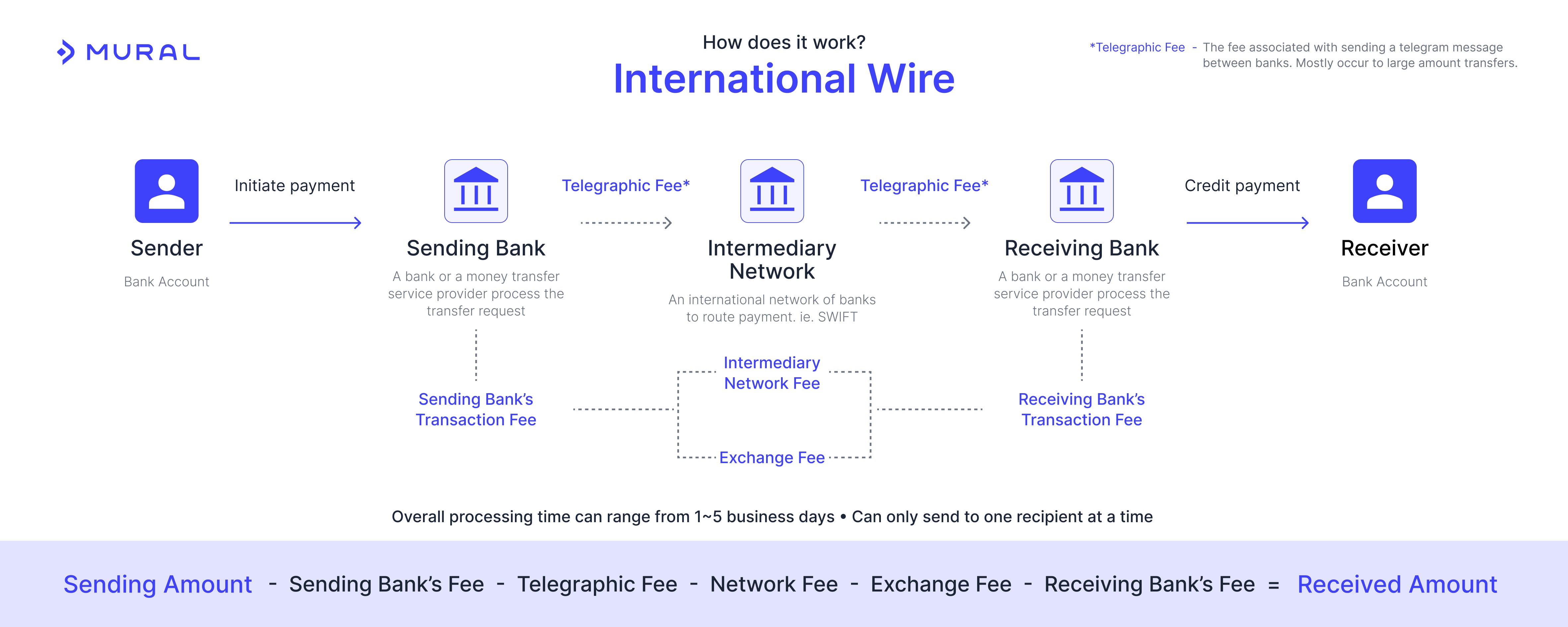

Understanding Wire Transfer Fees

Wire transfer fees encompass the charges incurred when sending money internationally between banks. They can be split into two main categories: visible fees, which are disclosed upfront, and hidden costs, often concealed within exchange rates or not explicitly stated.

Types of Fees Associated with Wire Transfers

Sending Fees

Banks typically charge a fee to initiate a wire transfer. For instance:

Bank of America: Domestic: $30; International: $0 in foreign currency and $45 in US dollars

Chase Bank: Domestic: $25-35; International: $5 in foreign currency and $40-50 in US dollars

Wells Fargo: Domestic: $25; International: $0 in foreign currency and $25 in US dollars

TD Bank: Domestic: $30; International: $50

Citi Bank: Domestic: $25; International: $35

Receiving Fees

The recipient’s bank may also impose a fee for handling incoming international funds, generally ranging from $15 to $30 across all banks. More specifically:

Bank of America: Depends on account type

Chase Bank: Domestic: $15 or $0 if payment sent via branch; International: $35

Wells Fargo: Domestic: $15; International: $15

TD Bank: Domestic: $15; International: $15

Citi Bank: Domestic: $15; International: $15

Intermediate Bank Fees

Many international transfers pass through intermediary banks, each potentially deducting fees, which can further reduce the transferred amount. For example, if a wire transfer from the U.S. to Japan passes through two intermediary banks, each could deduct a fee, potentially totalling an extra $20-$40 off the original amount sent. Typical fees range between $15 and $30 from each intermediary bank.

Currency Conversion Fees

Banks may also charge for currency conversion, more often hidden rather than listed as a separate fee, which is why a lot of banks do not charge an outgoing international wire fee if money is sent in a foreign currency, they earn money on the unfavorable exchange rate. This cost can vary widely depending on the bank and the currencies involved, usually marked up 1-3% above the mid-market currency exchange rate. For instance, for converting USD to EUR, if the mid-market rate is 1 USD = 0.85 EUR, a bank might apply an exchange rate of 1 USD = 0.83 EUR, effectively charging a hidden fee through the rate.

How Fees Vary by Country

The hidden fees associated with international wire transfers can vary significantly based on the destination country. This variance is not just a reflection of the different banking systems and infrastructures in place but also of local laws, currency exchange practices, and the network of intermediary banks involved in the process.

Impact of Destination Country

Banking Infrastructure: Countries with developed banking systems often don’t need to use intermediary banks, and so avoid additional fees on receiving and sending international transfers.

Regulatory Environment: Local financial laws also affect transfer costs. Some countries have stringent regulations that might necessitate additional compliance measures from banks, increasing the costs.

Currency Exchange Practices: The approach to currency exchange varies by country. In nations with volatile currencies, banks might charge higher conversion fees to mitigate exchange rate risks.

Interbank Agreements: Some banks in different countries have a direct relationship and can agree to lower costs for their users to send and receive money internationally.

The impact these variables have can be seen in the example comparing sending money from the US to the UK and to Nigeria. Fees to the UK might be relatively lower due to the strong banking relations between the two countries, widespread use of the British Pound, and the advanced banking infrastructure in the UK. Meanwhile, Nigeria has stricter financial laws and a less stable currency. This can result in comparatively higher fees of sending money there from the US.

Avoiding High Fees in International Transfers

Using Third-Party Services: Platforms like Payoneer and Wise offer more transparent fee structures and use the real exchange rate, potentially saving significant amounts in hidden fees.

Choosing Local Currency for Transfers: Sending money in the recipient’s local currency can circumvent the inflated exchange rates and conversion fees typically levied by banks.

Understanding Bank Partnerships: Selecting banks with international partnerships can lead to reduced or waived fees on transfers, emphasizing the importance of informed bank choice.

Use Digital Dollars: Digital currencies like stablecoins offer international payments with instant settlement and low fees. Digital dollars bypass intermediary banks' high fees and allow for direct transfers. Stablecoins also offer increased financial inclusion as there is no need for banks, and anyone with internet access can utilize this technology. Platforms like Mural are at the forefront of this innovation, offering cost-effective and easily accessible international payment solutions

How Mural Alleviates Fees

At Mural, we understand the challenges and costs associated with international transactions. That's why our innovative payments platform leverages the power of stablecoins to navigate and substantially reduce the complex web of fees that traditionally accompany international wires. Here's how we make a difference:

No More Hidden Fees: We eliminate those frustrating, undisclosed charges, ensuring you keep more of your money.

Fair and Transparent Exchange Rates: We believe in honesty and clarity, offering rates that are straightforward and equitable.

Simplified Transactions: Our process is streamlined for speed and cost-effectiveness, making global transfers quicker and more economical than ever.

Experience the transformative power of Mural's cutting-edge technology, setting a new standard in international payments. Embrace the future of financial transactions with confidence and ease, as we redefine what it means to move money globally.

Conclusion

Navigating the maze of fees in international wire transfers can be daunting, yet understanding and utilizing the right strategies can lead to significant savings. We explored the various types of fees from different U.S. banks and highlighted strategies to minimize costs, including the innovative approach of using digital dollars through platforms like Mural. By leveraging stablecoins, Mural offers a transparent, cost-effective solution for international transfers, sidestepping the hidden fees and unfavorable exchange rates typical of traditional banks. As we move towards a more interconnected global economy, the efficiency, transparency, and savings provided by digital finance platforms like Mural become increasingly essential. To discover how Mural can streamline your international transfers book a demo today. Embrace the change and join us in redefining the landscape of global finance.