Why Do You Need Transaction Monitoring?

Transaction monitoring has become an essential component in any financial compliance program. The regulation surrounding it and the various transaction monitoring tools available on the market can often cause businesses confusion.

What is Transaction Monitoring exactly?

Transaction monitoring is the technology and continuous process of detecting any abnormal activities in real-time. This allows businesses of all sizes to ensure the recipient destination or the source of funds has no connection to the funds associated with money laundering. Anti-money laundering (AML) transaction monitoring has become a mandated procedure by AML laws in Customer Due Diligence (CDD) rules. This requirement applies to all fiat transactions (USD, EUR, ARS, COP, etc.), and in certain jurisdictions, to digital currency transactions (USDC, USDT, etc.) as well. However, transaction monitoring in the digital currency landscape can be more complex, and therefore, a solution like Mural that provides Transaction Monitoring and KYC/KYB out of the box as part of your monthly plan can be the simplest and the most economical solution.

Why do you need transaction monitoring?

Prevent Interacting with Illicit Addresses

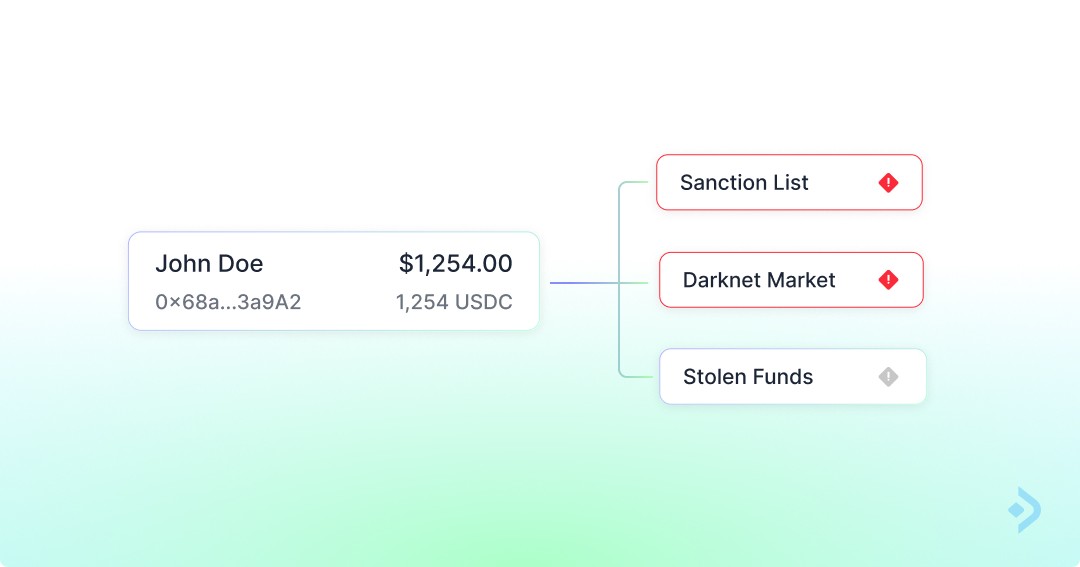

Businesses want to prevent any association with a wallet address that has previously engaged in illicit activities, such as dark net market sales, money laundering, stolen funds, etc. In 2023, over $24.2 billion was sent to illicit wallet addresses. While engaging with illicit addresses can be preventable, without a transaction monitoring tool implemented, it’s difficult to evaluate the recipient addresses individually and in bulk. In 2022, digital currency trading platform Robinhood received a $30 million penalty for failing to meet cybersecurity and AML obligations. To ensure every transaction is safe and compliant, Mural screens every wallet you send funds to and warns if the recipient is associated with any illicit or high-risk activity so that you can send a payment with true confidence.

Proactive Compliance Control

Every business’s financial and compliance teams are working together on a robust compliance program to satisfy the fast-changing transaction monitoring regulations proactively. Oftentimes, the various options on the market will take months to evaluate and go through approval, eventually demanding a very high budget. Mural provides the easiest way for businesses, from a small start-up to enterprise level, to start or enhance their compliance program without spending extravagant amounts of time and money every year on additional solutions.

Build Trust with Customers

Nowadays, when customers are shopping for solutions, whether the business they are evaluating has a robust compliance policy has become an essential criterion. Customers are checking the boxes of whether the company has transaction fraud detection in place and whether it is working with other businesses that also provide a strong compliance program. Therefore, having a robust risk-control policy is a foundational step to maintaining security and compliance and building trust with your customers.

Conclusion

Transaction monitoring has become a requirement for business financial operations. Adopting a product like Mural, which provides KYC and transaction monitoring out-of-the-box amid the fast-changing AML rules, can help your business embrace blockchain cross-border payment faster and more compliantly.